Modern students worldwide often rely on platforms such as Coursera, Udemy, Khan Academy, Grammarly and Google Scholar or digital services for their studies.

However, for residents of Nigeria, paying for these services can be problematic. Many services, including academic platforms, automatically block payments from users in Nigeria and other African countries for security reasons. Additionally, another challenge with payments is that local bank cards only support transactions in naira, while international services accept payments in dollars. Currency conversion often doubles the payment amount.

The primary solution to these issues has become virtual cards. These are payment tools that function like regular bank cards but exist only in digital form. They have a card number, expiration date and CVV code, just like standard cards.

Virtual cards allow users to use popular currencies such as US dollars for international payments. Many modern financial providers of virtual cards work with reliable payment systems such as Visa or Mastercard. This enables users to pay for any foreign services and generally make payments wherever Visa and Mastercard are accepted.

Why are virtual cards better than standard bank cards?

- They are safer for online payments: Virtual cards are better protected against fraudulent activities online. Limits can be set on them, or they can be used only for payments on specific platforms. Additionally, unlike physical cards, they cannot be lost.

- Virtual cards support the world’s most popular currencies – the US dollar and the euro: This saves time on currency conversion and makes it easy to pay for foreign services.

- Virtual cards are convenient to manage: All card transactions are displayed in the user’s personal account on the website. There, users can monitor all expenses and keep track of the account balance.

What makes virtual cards an ideal payment tool for students?

- Easy Card Issuance: They can be obtained without going to a bank and filling out complex forms. Virtual cards are created online in just a few minutes.

- Worldwide Acceptance: Most fintech brands work with reliable banks in Europe and the US. They issue cards suitable for payments worldwide. With these cards, users can pay for digital services, software, and even make regular purchases on international resale platforms.

Here, we will review three financial providers of virtual cards that can be used to pay for foreign educational services.

1. The Ultima Cards (PSTNET)

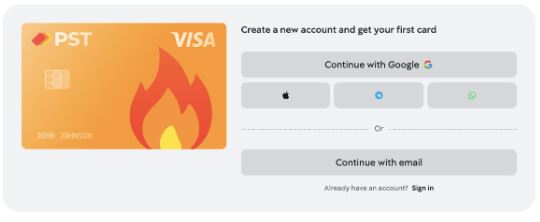

The financial platform PSTNET offers virtual cards that can be used globally.

The Ultima Card is the platform’s most popular card, compatible with Visa and Mastercard payment systems, and can be used to pay for any educational service.

The Ultima Cards are instant virtual debit cards. To get one, you need to register on the PSTNET platform. Registration takes just a few minutes. You can use your Google, Telegram, WhatsApp, Apple ID or email account. You can even get your first card without any documents.

One of the main advantages of the Ultima Card for students is that it has no limits or restrictions. The card can be used for transactions of any amount, with no minimum or maximum deposits.

The Ultima Card supports 3D Secure technology, providing an additional level of payment security. Users receive a special code via SMS or Telegram bot, ensuring that all transactions are securely protected from fraudsters.

Features:

- 2% top-up fee

- The card can be topped up using any other Visa/Mastercard, cryptocurrencies (USDT TRC20, BTC, and 15+ coins), or via SWIFT or SEPA bank transfers

- Functional Telegram bot: receive service notifications and 3DS codes

- Responsive customer support: managers are available 24/7 and can be contacted via Telegram, WhatsApp, or email

2. Chipper Cards

The financial platform Chipper offers various types of virtual cards for residents of Nigeria, Uganda, Rwanda, and Southern African countries. For international payments, only the service’s dollar card is suitable. It operates with Visa’s payment system, making it usable for paying for educational platforms and digital products. One important detail to note is that, before making international payments, it is advisable to verify if the platform accepts Chipper cards. This can be easily done on the service’s website.

The Chipper USD Card has spending limits – you can spend up to $1,000 per day and up to $4,000 per month. These limits are more than sufficient for paying for educational services.

To obtain the card, you need to download the Chipper app and complete the verification process. This requires using your passport or ID, as well as confirming your address and phone number. The service will verify the information and confirm the account within two working days. After this, you can easily issue the card directly in the app.

Features:

- Issuance fee: 1000 NGN

- Top-Up Balance: You can add funds to your card by selecting your NGN account in your personal account and topping up. The balance on the card will be in dollars.

3. PayDay Cards

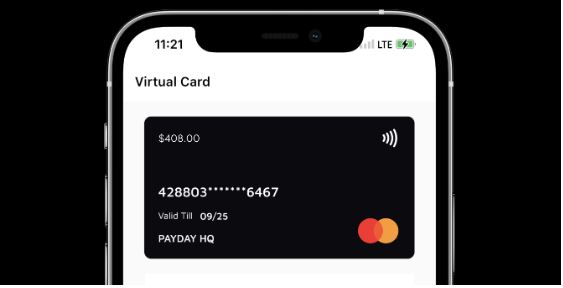

The financial platform UsePayDay provides virtual wallets and linked virtual cards. The service is primarily used by residents of Nigeria and Rwanda to receive international transfers from other countries. However, the platform’s cards work with payment systems such as VISA, MasterCard, and Verve International, making them suitable for paying for overseas educational services.

To issue a UsePay virtual card, you first need to download the app and complete the verification process. Nigerian residents need to use their BVN and a selfie. The system will verify the information and grant access within the app. To use the virtual cards, you need to top up your PayDay wallet.

Features:

Top-up balance via PayDay Wallet: You need to use your NGN account and convert the currency to USD in your personal account. After this, you can transfer the funds to the dollar card.

Conclusion

In summary, virtual cards present numerous advantages that make them an excellent payment solution for students in Nigeria. Their enhanced security, support for widely used currencies, and ease of management set virtual cards apart from traditional bank cards when it comes to online payments. Moreover, these cards can be issued quickly and conveniently online, eliminating the need for physical bank visits, and are widely accepted for international transactions.

Choosing the right virtual card is essential to ensure seamless access to educational resources. Options like the Ultima Cards from PSTNET, Chipper Cards, and PayDay Cards provide students with reliable and efficient tools for paying for international educational services. By utilizing these virtual cards, students can concentrate on their studies without the worry of payment difficulties.

Add a Comment